charitable gift annuity administration

Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Visit The Official Edward Jones Site.

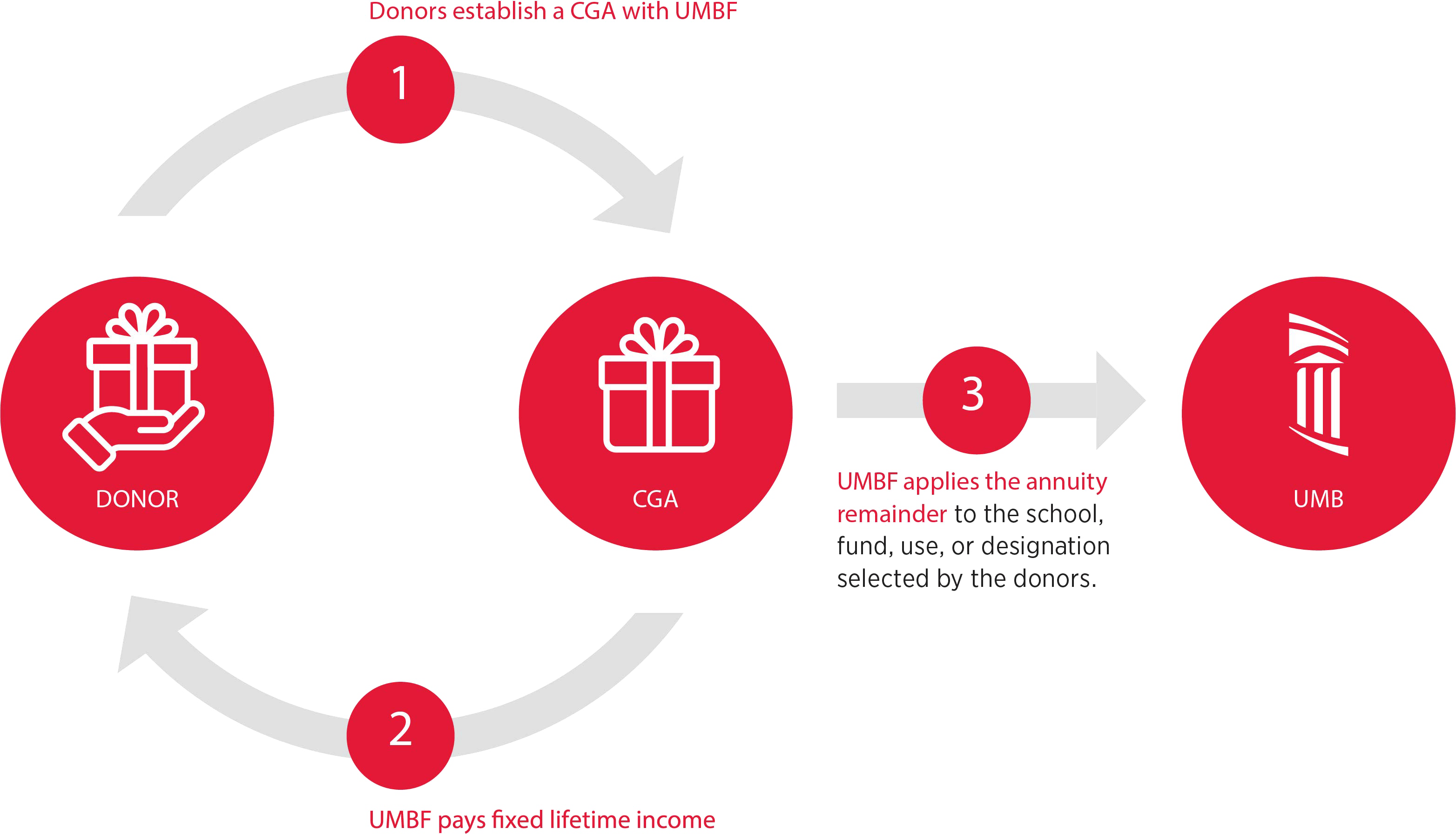

The Umbf Charitable Gift Annuity Planned Giving

It is possible to fund a charitable gift annuity with cash securities or any other asset.

. Preserves the value of. Initial funding may be as little as 5000 though they tend to be much larger. What is a charitable gift annuity.

The base WatersEdge administration fee is 105. However the tax treatment of an annuity trust. Because they need continuing income they decide to give the cash in.

Encourage the benefactor to do everything on the same day such as write the check and mail it on the same day. If the assets for the gift are coming from more than one location make sure. Ad Earn Lifetime Income Tax Savings.

Learn some startling facts. Charitable Gift Annunity Administration Establish CGA administrative pools for efficient monitoring and payment management. A charitable gift annuity is a contract between a charity and a donor that in exchange for an irrevocable transfer of assets to the charity the charity will pay a fixed sum to the donor andor.

Charitable gift annuities CGA are gifts that give back and pay you income for life. Find a Dedicated Financial Advisor Now. This income will continue as long as you andor your beneficiary survive.

There is an additional fee of 50 for charitable gift annuities and its proceeds fund an annuity reserve fund that guarantees. In exchange for a gift of assets ie cash stock bonds real estate etc the. Duke also issues charitable remainder annuity trusts with gifts of 100000 or more.

Foundation to establish a Charitable Gift Annuity. It is a contract with a charitable organization for a stream of payments in a fixed amount payable in annual or other more frequent installments over a. Again the value of the IRA at the account holders death in included in the donors gross estate per the IRS but the estate may claim a charitable deduction for the portion.

Maintain complete accurate and confidential records. A charitable gift annuity CGA is a simple agreement between an individual and a non-profit organization. Our donor age 75 plans to donate a maturing 25000 certificate of deposit to the International Rescue Committee.

Charitable Solutions LLC in Jacksonville FL administers and works with the National Gift Annuity Foundation NGAF. Like a gift annuity an annuity trust makes fixed payments. Based on their ages they will receive a payment rate of 39 which means that they will receive 780 each.

When you give a CGA you make a contribution of cash marketable securities or other appreciated property. Payment rates depend on several factors including your age. Give Gain With CMC.

Based on her age of 75 and a federal discount rate of 16 percent she will receive an annual annuity at a rate of 54 percent. Charities that offer charitable gift annuities should be aware that many states regulate the issuance of gift annuities. A charitable gift annuity is a way to donate to a nonprofit and receive a stream of lifetime payments in return.

Although in most cases this would be. It can also alleviate the administrative burdens of. 125 rows Since 1955 the ACGA has targeted a residuum the amount remaining for the charity at the termination of the annuity of 50 of the original contribution for the gift.

Ad Earn Lifetime Income Tax Savings. Usually regulation is under a states Insurance or. Key benefits of charitable gift annuities Secures a source of lifetime income.

A charitable gift annuity may be funded with cash securities or a variety of other assets. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Do Your Investments Align with Your Goals.

Give Gain With CMC. Send a cover letter there is no formal application form along with the materials requested. They establish a 20000 charitable gift annuity through our foundation partner.

New Look At Your Financial Strategy. When you give a CGA you make a contribution of cash marketable securities or other. The initial investment may be as little as 5000.

Charitable gift annuities CGA are gifts that give back and pay you income for life. Ad Annuities are often complex retirement investment products. Toapply for a special permit to issue charitable gift annuities.

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Charitable gift annuity reinsurance is a way of transferring certain risks associated with your CGA program to an insurance company. We offer deferred flexible and immediate gift annuity structures and the.

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

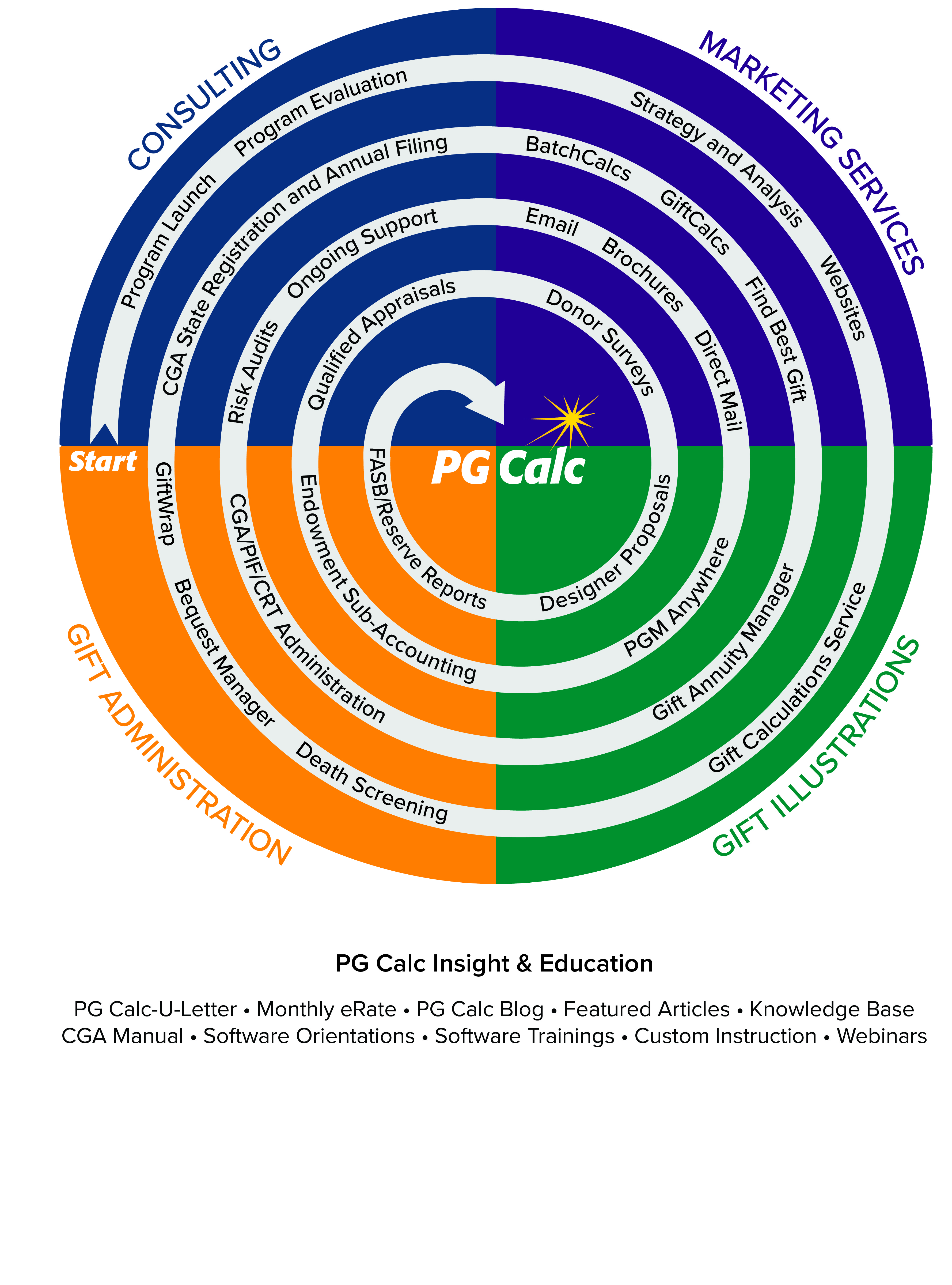

Pg Calc And Planned Giving Pg Calc

4 Long Term Ways To Give To Charity Capstone Financial Advisors

4 Long Term Ways To Give To Charity Capstone Financial Advisors

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

American Council On Gift Annuities Home Facebook

Cga Services National Christian Foundation

Charitable Gift Annuities Giving To Duke

6 Benefits Of A Charitable Gift Annuity Giving To Duke

Is It Worth Starting A Charitable Gift Annuity Program Cck Bequest